31st July is the last day to file your income tax returns this financial year, 2018-19. Nothing proves your financial wisdom and ethics like tax compliance – timely filing of ITR. Filing your income tax return is not as difficult as it may sound. Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.

Step 1: ITR Efiling – Getting Started

Before we get started, you should have the following documents at hand to pace up the process:

PAN

Adhaar

Bank account details

Form 16

Investments details

Login to your ClearTax account.

Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format. If you do not have Form 16 in PDF format click on ‘Continue Here’

Step 2: Enter Your Personal Information

Enter your name, PAN, Date of birth and father’s name.

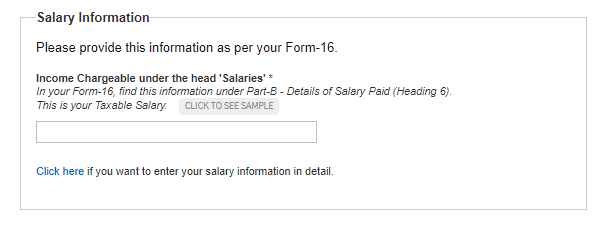

Step 3: Enter Your Salary Details

3a. Fill in your employer name and type.

3b. Provide your salary and TDS information. For entering the break up of your salary in detail ‘Click here’.

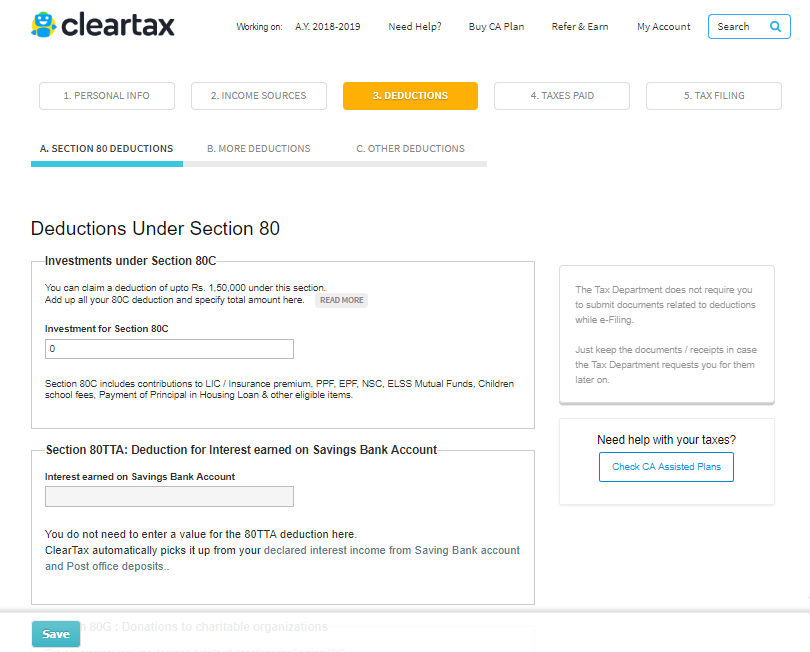

Step 4: Enter the Details for Claiming Deduction

Enter investment details for deductions to be claimed (eg. LIC, PPF etc., and claim other tax benefits here.

Step 5: Enter the Details of Taxes Paid

If you have any non-salary income, say, interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26AS.

Step 6: e-File

Enter your bank account details and proceed towards e-filing.

If you see ‘Refund’ or ‘No Tax Due’ here, Click on proceed to e-Filing. You will get an acknowledgment number on the next screen.

Tip: See a ‘Tax Due’ message? Read this guide to know how to pay your tax dues.

Step 7: E-Verify

Once your return is filed e-Verify your income tax return.

Watch this video to know how to e-File ITR Online

No comments: